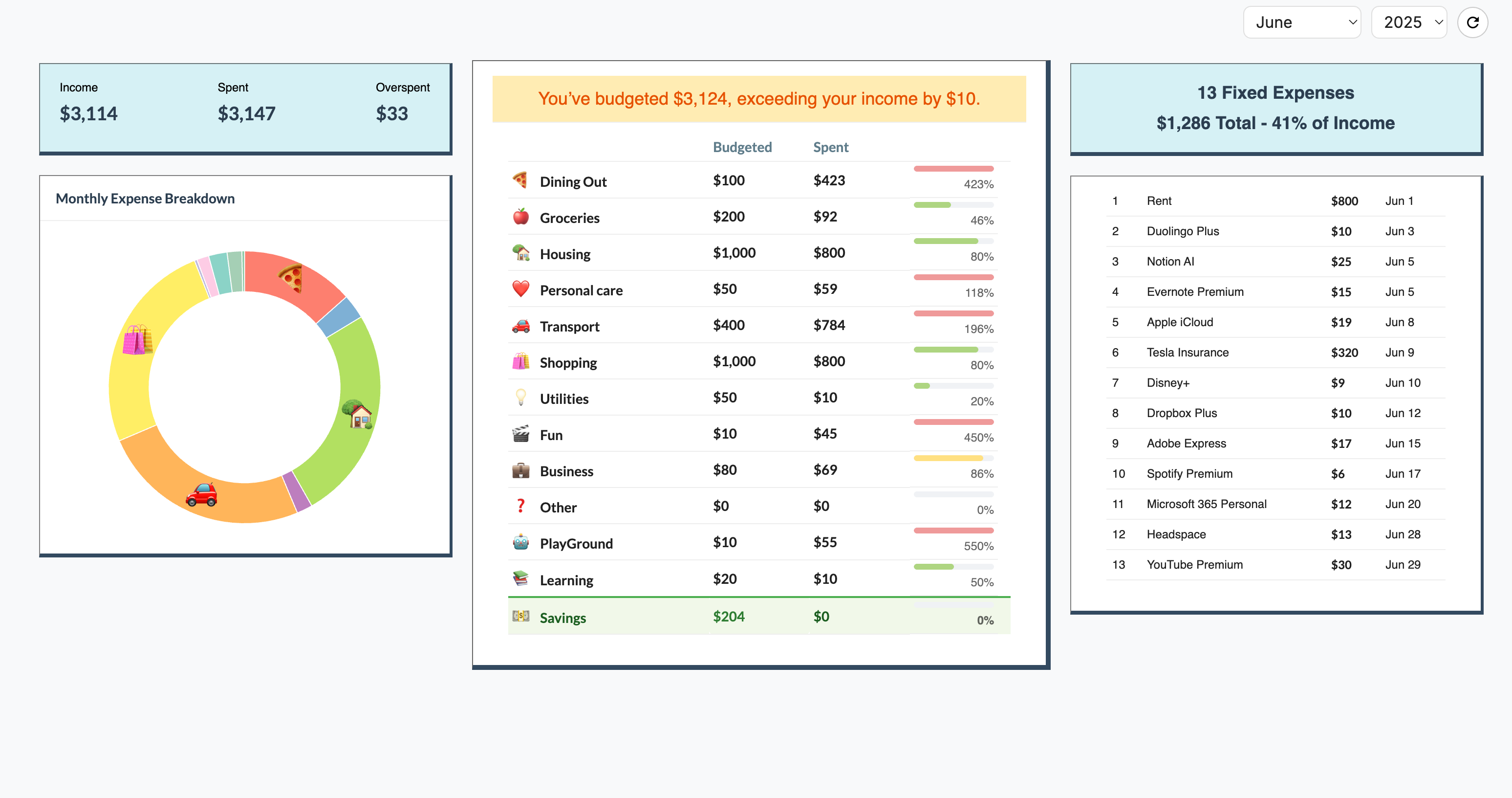

Dashboard: Monthly Budget Overview

The dashboard displays your income, expenditures broken down by spending categories, and remaining budget. You can set both spending and saving goals to track your financial targets.

A fixed expenses list shows all monthly subscriptions next to the budget table. These fixed expenses automatically appear as spent from day 1 in their spending categories so you know exactly how much money you have left to spend.

What You See at a Glance

Money Left to Spend

See exactly how much you can still spend this month. Whatever you don't spend becomes your savings automatically.

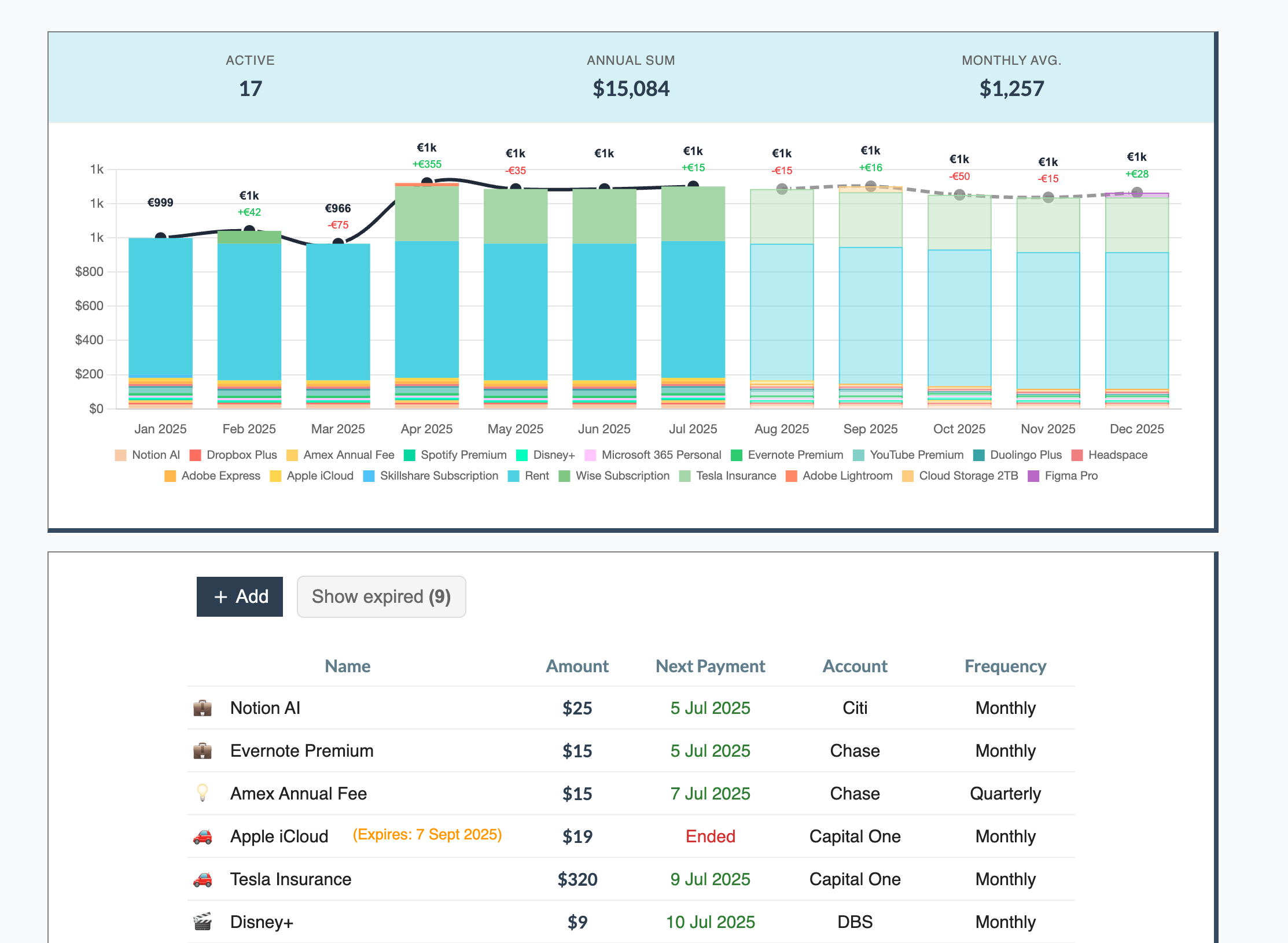

Fixed Expenses List

All fixed expenses are listed so you don't miss their due dates. They already show as spent in the budget table so you know how much money you've left for the month.

Budget goals: Set and edit target amounts directly in the budgeted column. Spending data flows from your expense and income tabs. Fixed expenses are automatically included in your spent totals. Goals automatically carry over to the next month, which you can adjust if needed or leave as is - since most people have similar spending goals each month, this carryover feature saves time.

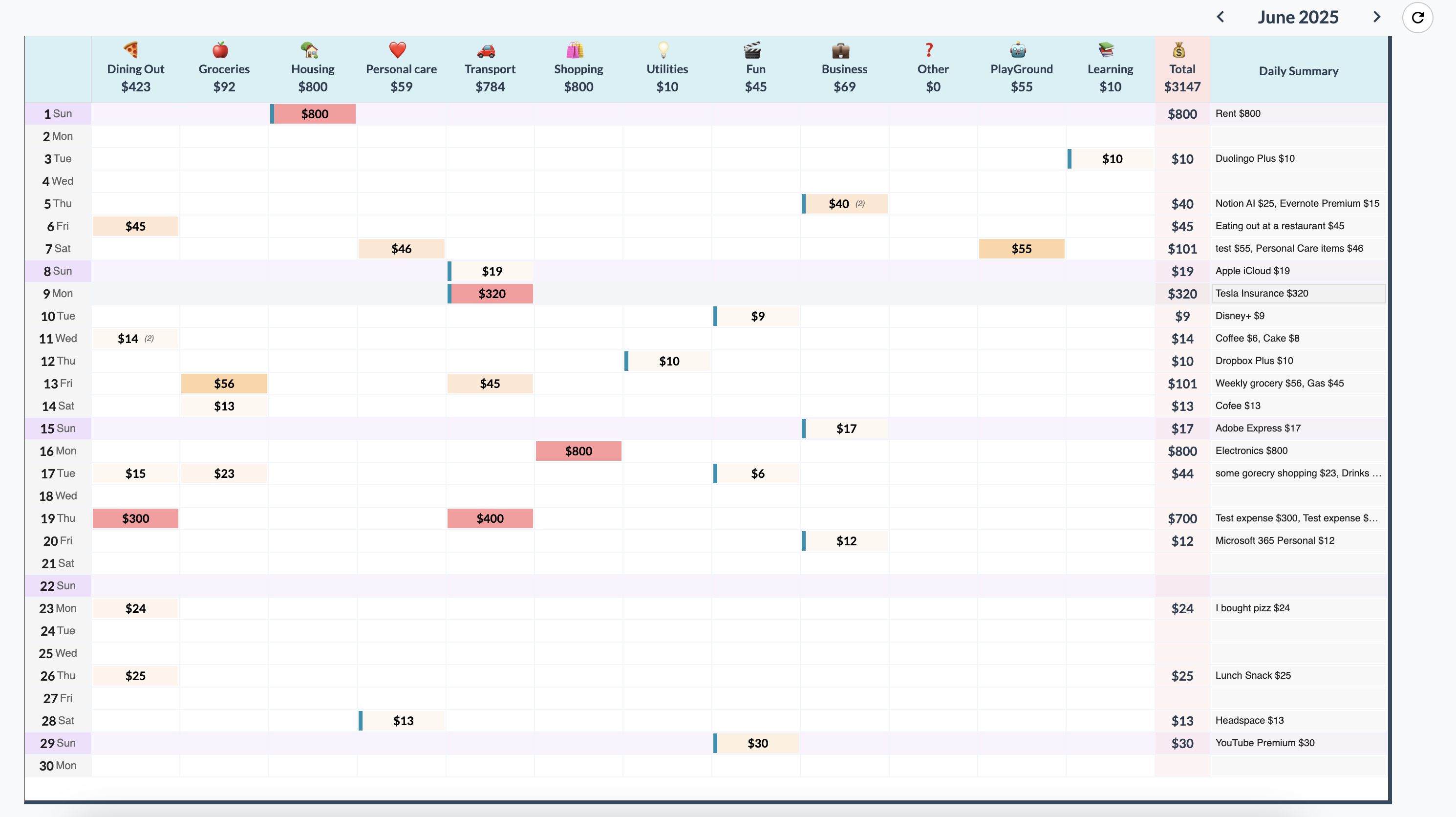

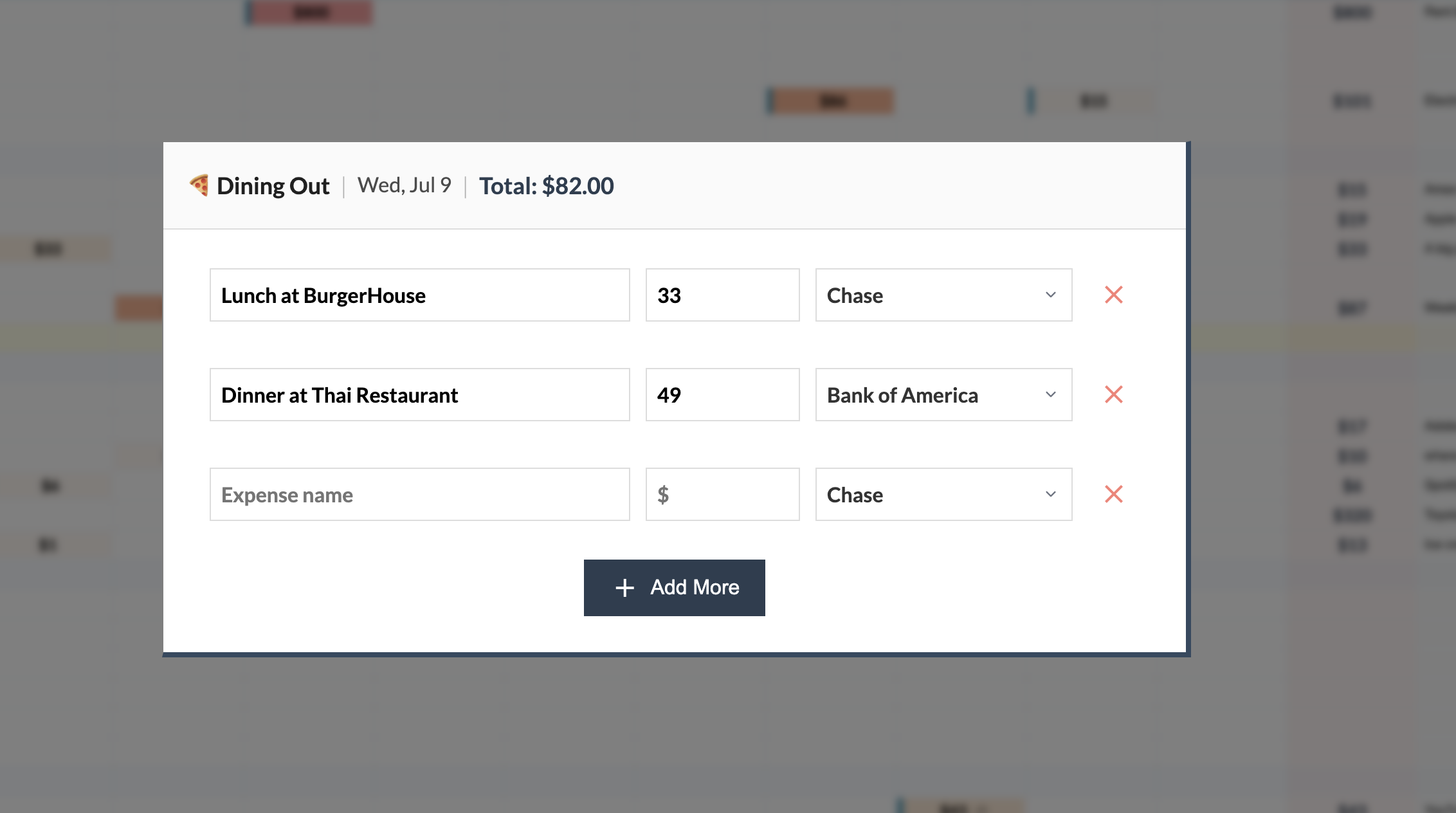

Expense Entry: Fast & Simple

Click where any date meets any category to add an expense. Enter the amount and description. You can add multiple entries per day or just enter the daily total for that category. It's lightning fast and works perfectly on your phone.

Here's what happens when you open the expense popup:

- • All existing expenses for that day/category

- • Empty row to add new transactions

- • Category emoji and date at the top

- • Running total for that day

- • No save button needed - auto-saves when you click outside

- • Red X to delete any transaction instantly

Fixed Expenses: Enter them once and they'll appear automatically on each pay cycle

Manage your active fixed payments (bills, subscriptions, and memberships). Anything that automatically charges your account monthly, quarterly, or yearly gets entered here once, and you'll see when payments are due so you never get surprised by charges.

The list is ordered by due dates first so you never get surprised by bills or payments coming up.

Subscription Chart

The chart shows you current year's subscriptions with projected payments through the end of the year. You can toggle it on and off.

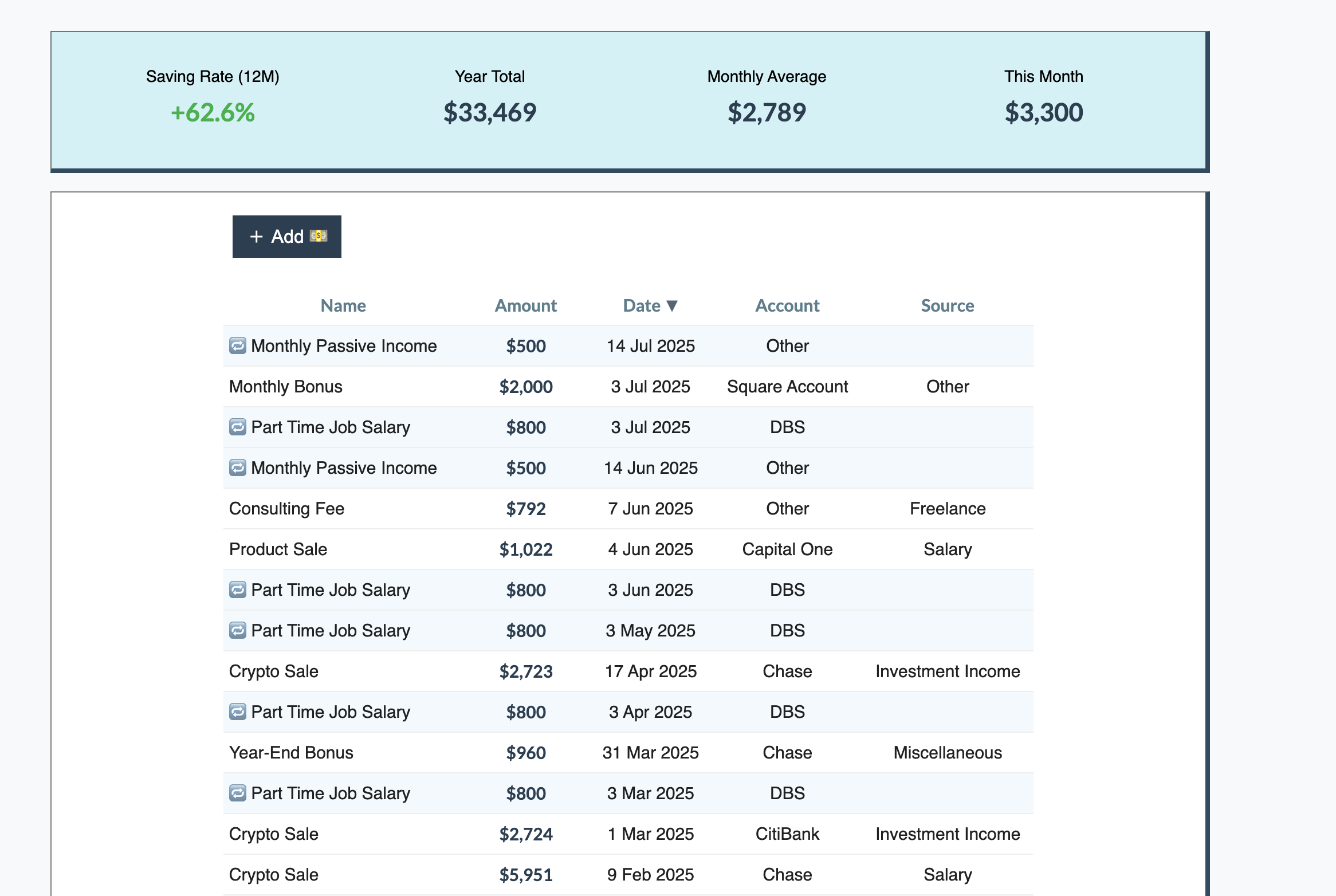

Income Tracking

Add money when you get it - paychecks, side hustle earnings, gifts, whatever. You can set it as recurring income or one-time to track what's coming in each month.

Two Income Types

One-time income:

Freelance payments, bonuses, side hustle earnings, investment sales, money from savings, loans (adjust net worth accordingly)

Recurring income:

Salary, passive income, regular dividends

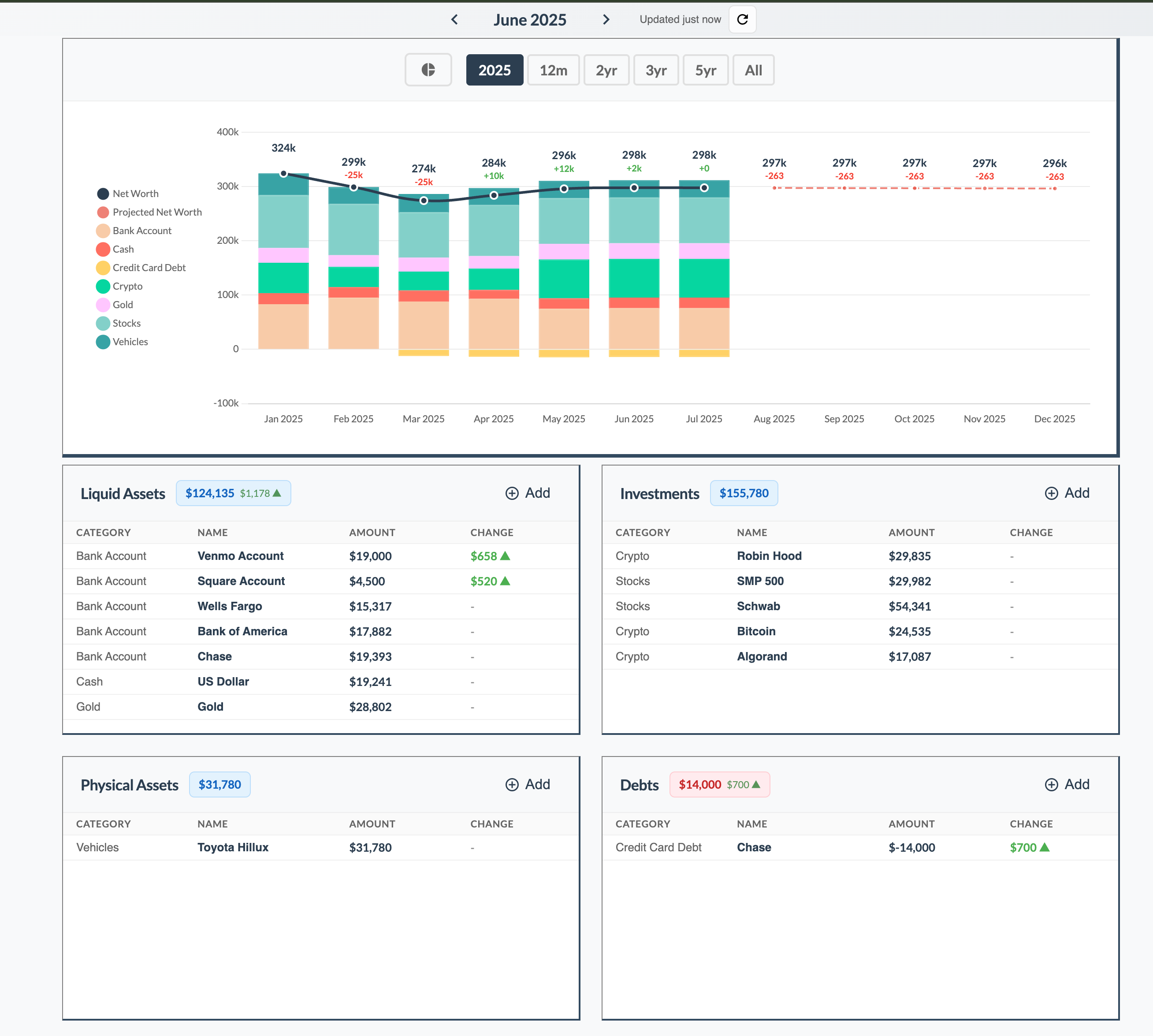

Net Worth Tracking

Track your total net worth across four simple categories: liquid assets, investments, physical assets, and debts. Update monthly with your actual account balances.

Four Simple Buckets

Liquid Assets

Bank accounts, cash, money market - anything you can spend immediately

Investments

Stocks, crypto, retirement accounts, real estate - your wealth-building assets

Physical Assets

Car, electronics, furniture - valuable things you own

Debts

Credit cards, loans, mortgages - what you owe

Monthly Updates

End of month routine:

- • Check bank account balance → Enter in Liquid Assets

- • Check investment account value → Enter in Investments

- • Estimate physical asset values if changed → Update Physical Assets

- • Done in 5 minutes, accurate forever

No daily market stress, no sync failures, no reconciliation headaches - just a clear monthly snapshot of your complete financial picture.

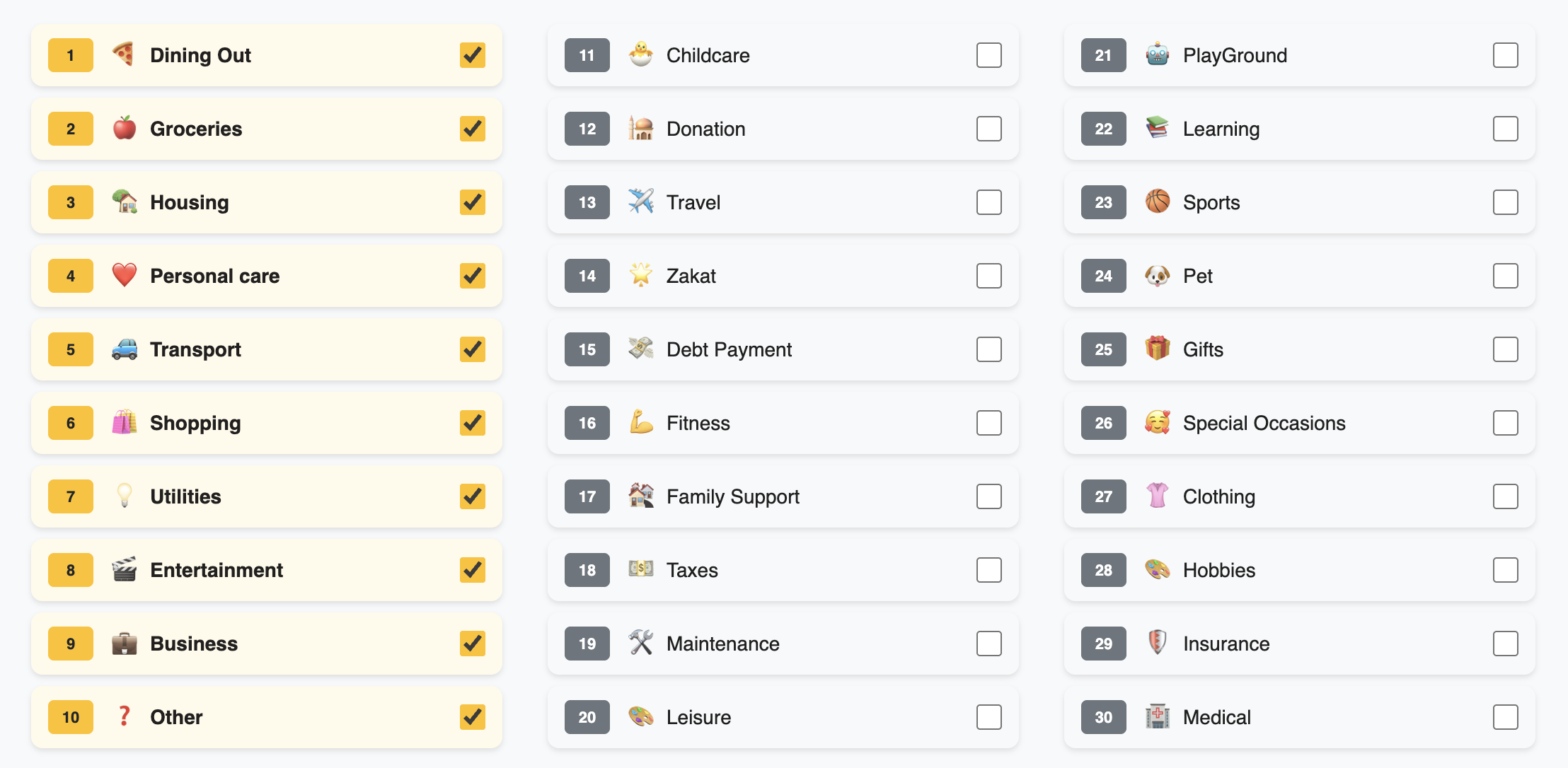

Category Management

Choose from 30 pre-built categories and activate only the ones you use. Rename and rearrange them to match your needs - changes automatically appear in dashboard, expense, and subscription views. Archive unused categories to keep them out of the way while preserving transaction history.

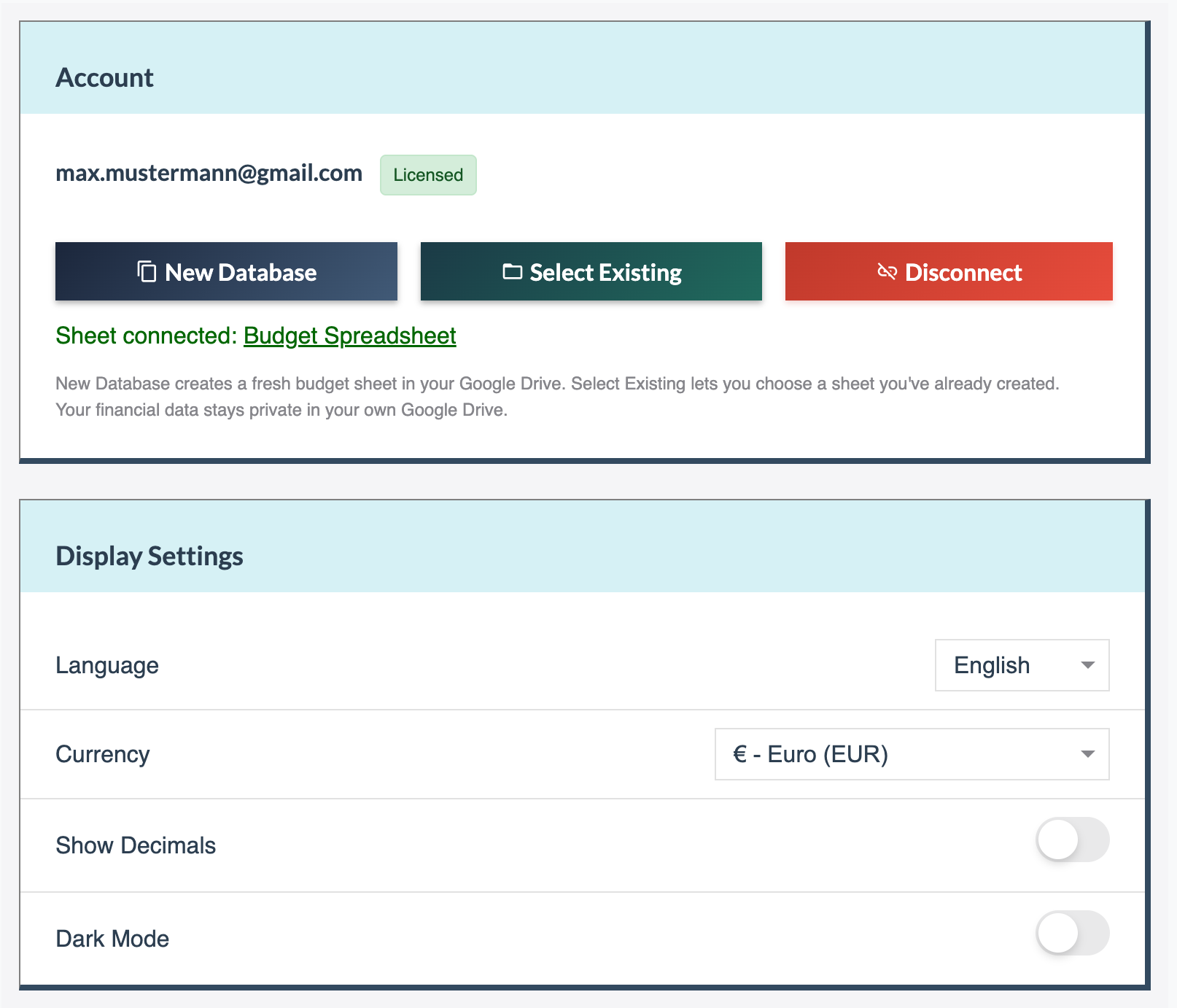

Settings & Data Setup

Create a new Google Sheet in your Drive to store your financial data, or connect to an existing one. Only you have access to the sheet since it's in your own Google Drive. Share it with family members to track finances together, or disconnect anytime to unlink the current sheet.